Does Amazon Prime Charge Tax

Does Amazon Prime Charge Tax In 2022? (Your Full Guide)

Logo since 2000

|

|

|

|

| Amazon | |

| Formerly | Cadabra, Inc. (1994–1995) |

| Type |

Public |

|

|

|

ISIN |

US0231351067 |

| Industry | |

| Founded |

July 5, 1994 ( 1994-07-05 ) Bellevue, Washington , U.S. |

| Founder |

Jeff Bezos |

| Headquarters |

,

U.S.

|

|

Area served

|

Worldwide |

|

Key people

|

|

| Products | |

| Services | |

| Revenue |

US$ 469.822 billion (2021) [1] [2] |

|

US$24.879 billion (2021) [1] |

|

|

US$33.364 billion (2021) [1] |

|

|

Total assets |

US$420.549 billion (2021) [1] |

|

Total equity |

US$138.245 billion (2021) [1] |

| Owner |

Jeff Bezos (14.0% voting power, 10.6% economic interest) [3] |

|

Number of employees

|

1,608,000 (Dec. 2021) [1] U.S.: 950,000 (Jun. 2021) [4] |

|

Subsidiaries |

List

|

| Website |

amazon.com |

|

Footnotes / references [5] [6] |

|

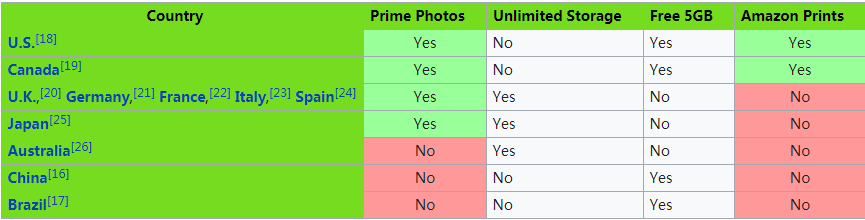

Amazon Prime provides a number of benefits to customers, such as unlimited photo storage, access to Amazon Prime Video, free shipping, and a variety of other perks for a small fee per month.

Does Amazon Prime Charge Tax In 2022?

Amazon Prime memberships will now be charged tax in certain states. Amazon will also charge tax according the customers’ tax laws and amounts. The difference will be calculated at checkout. Amazon doesn’t charge tax in every area, and only 34 states are subject to it.

Is Amazon Prime Tax-Free in All States?

Amazon Prime doesn’t charge taxes in every state. Amazon Prime does not charge tax in all states. Only 34 US States currently pay the applicable tax.

These are the states which must pay taxes for Amazon Prime.

If you are looking to buy an Amazon Prime membership, it is a good idea to look at this list. It will show you if your state has to pay taxes on the membership.

How Does Amazon Prime Calculate Tax?

Amazon will calculate taxes for purchases based upon the following:

Amazon determines tax when they fulfill an order. This is based on local and state laws.

Amazon Prime is an Amazon service. Amazon could calculate the tax in a way that’s different from normal, if they lived in a place where they have to tax.

Amazon Prime customers should therefore be well aware of any tax that they will have to pay when purchasing a membership.

Amazon Prime Pricing After Tax: What Is It Worth?

When customers purchase Amazon Prime, the total will vary slightly depending on whether customers live in a state that requires them to pay taxes or not.

Amazon Prime costs $119 per annum or $12.99 per months if the customer does not have to pay tax. However, tax-paying customers could end up spending up to $130 each year depending upon the state’s tax rates.

Customers who reside in California, for example, must pay 8.60 percent sales tax on top of the original price of Amazon Prime.

Customers will also need to consider local taxes in addition to state taxes. This will affect the final amount they pay.

Amazon Prime will be priced differently in each state, depending on tax. But the $119 base price applies universally.

Inquiring customers about the amount that will cost them to join Prime are advised to add their taxes and their state to Amazon Prime’s base price.

Amazon Prime is Exempt from Tax

Amazon charges tax for Amazon Prime memberships because it is required by The State Department of Revenue. While not every state is charged tax for a Prime membership, those that do pay tax are required to by law.

Amazon Prime members have complained about being charged tax for their Prime membership. However, retail memberships are not usually subject to taxes.

RCW states, however, that retail tax applies to memberships if the components of the product or service are included.

In other words, Amazon Prime memberships are subject to taxes because they provide a range of services like shipping and handling that can be subject to retail tax.

How can I avoid Amazon tax?

Amazon Prime members cannot avoid having to pay taxes. Customers must be in the one of the 16 US states not subject to tax to get Amazon Prime.

Amazon allows customers to purchase any other items without tax. This is provided that the customer lives in an area where Amazon doesn’t charge sales tax.

We have posts about Amazon Prime that will help you learn more. These include how to cancel Amazon Prime and Amazon Prime trial without credit card. How many Amazon Prime can be used on different devices.

Amazon Prime is subject to tax in all 50 US States. Amazon Prime’s base price is $119/year. But, prices can rise to up to $130/year depending on which state taxed customers.

Amazon determines the tax due to the tax laws of the place where it was completed. Amazon Prime is an online service that requires shipping, so there might be some slight differences in the tax costs.

Amazon Prime Membership: Does Amazon Charge Tax?

Do you have to pay tax for Amazon Prime membership fees Amazon Prime membership fees are subject to sales tax in each state. But the tax is not applicable across all states in the US. Amazon Prime membership fees will be subject to taxation in 34 US states as well as the District of Columbia.

How Much Does Amazon Prime Cost for 2022?

The new rates will be effective for Prime members who renew after March 25th, 2022. Coming changes: Monthly Prime membership prices will rise to $14.99/month and annual Prime membership prices will go up to $139/year.

.Does Amazon Prime Charge Tax In 2022? (Your Full Guide)